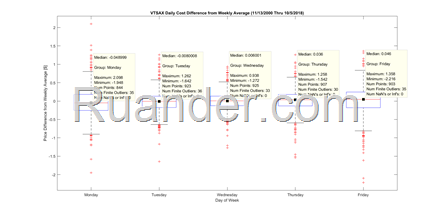

If you are into low cost index investing, you have probably heard and are buying the Vanguard Total Stock Market Index Fund, particularly VTSAX. One of the great tools that Vanguard offers is free recurring automatic investment. Using this tool, one can automatically buy VTSAX at any desired frequency such as weekly, bi-weekly, monthly and so on. Just let Vanguard know the day of the week you want to purchase and the frequency. This particular process led me to ask the following question: Which day of the week is the best day to buy VTSAX? Assuming we define the best day to buy as the day of the week on which the VTSAX closing price is lowest, we can take a look at past data to answer this question. To do this, I downloaded the VTSAX price history from 11/13/2000 up to 10/5/2018 from Yahoo Finance. Using this historical dataset, I looked at 1) the closing price distribution per day of the week and 2) the price difference between the daily closing price and the weekly average price per day of the week. Using this data, one can easily see (plots are shown below) that Monday is the day of the week with the lowest median closing price as well as the largest negative closing price difference from weekly average. This result may or may not come as a surprise since on average, the market always goes up. Therefore, one would expect the Monday closing price to be, on average, lower than the Friday closing price. However, it is great to be able to confirm this using past price data. In addition to looking at the data over the time period mentioned above, I also took a look at the data over the last ~5 years. The results are the same and indicate that if you are doing recurring automatic investment, you probably want to buy on Mondays. Please feel free to take a look at the results below.

Here are the plots for the entire time period:

Here are the plots for the last ~5 years starting in Jan 2013:

Disclaimer: All investments involve risk. Past performance doesn’t guarantee future results. Use the material contained here at your own risk.

RainCloud Matlab Source: https://git.fmrib.ox.ac.uk/marshall/public/tree/master/raincloud_plots

No comments:

Post a Comment